Table Of Content

Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. The weather and climate have been central factors in luring and maintaining people in the LA-area. Although there are moments of inclement weather and hot summer days, LA residents are not discouraged from enjoying beaches or hike the hills throughout the year.

Agreeing on the Purchase Price

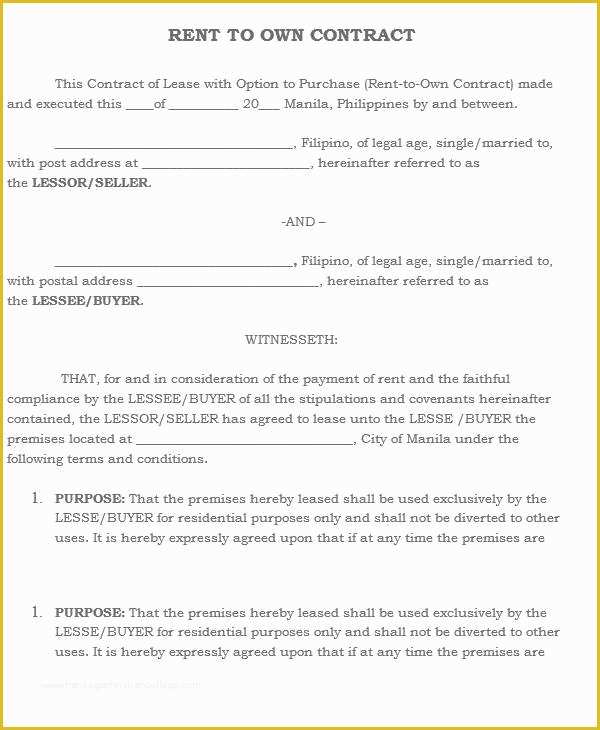

One difference is that you and the seller agree to a purchase price ahead of time. You can both agree to a price before you sign a lease agreement, or specify a date for a home appraisal and decide on a price after the appraisal is completed. You might need to pay an upfront fee to have this option included in the overall agreement — the option fee typically ranges from 1 percent to 5 percent of the total purchase price. And if a portion of your rent is being applied, called a rent credit, the designated percentage will be held escrow to be applied to your down payment later. Rent to own homes are those with leases that include either an option to buy or a requirement to buy after a certain period of time.

How Is Rent to Own Different Than Buying a House?

For example, if your monthly rent payment is $1,600, where $1,200 goes toward your monthly rent and $400 is set aside or “credited” toward the purchase price of the home. If your rental agreement is for two years, you’ll end up having $10,000 ready to be applied to your purchase at the end of your lease. Your contract should outline where your payments toward purchasing are kept. Ideally, these funds should be held in an escrow account or something similar to ensure they’ll be available to you at the time of purchase.

Buying house with 25 year land lease - Expat Forum

Buying house with 25 year land lease.

Posted: Thu, 04 May 2023 07:00:00 GMT [source]

Pros Of Rent-To-Own Homes

However, it’s not always easy to uncover these opportunities by simply browsing real estate listings or driving through your dream neighborhood, and you have to be wary of unscrupulous sellers. We talked to expert agents experienced in the rent-to-own process to show you exactly where to look and what pitfalls to watch out for. COPYRIGHTED PROPRIETARY MATERIAL of MetroList Services, Inc. data maintained by MetroList® may not reflect all real estate activity in the market.

Who Are Rent-to-Own Homes Right for?

Airbnb will have 11 Icons at launch, and is promising to refresh it with new offerings throughout the year. As such, areas outside the city, such as the San Fernando Valley, become more attractive to people seeking affordable housing. The pay-off to live in some of these areas are more congested traffic. Neighborhoods like Ocean Park and Westwood offer great places to walk, eat, and entertain guests in the heart of LA's good life. Before deciding on a rent-to-own agreement, make sure you think long and hard about the pros and cons.

Rent-to-Own Real Estate: The Benefits and Risks for Home Buyers - Realtor.com News

Rent-to-Own Real Estate: The Benefits and Risks for Home Buyers.

Posted: Sat, 06 Aug 2022 07:00:00 GMT [source]

For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. View the Chase Community Reinvestment Act Public File for the bank’s latest CRA rating and other CRA-related information. As a renter, you can spend time saving money or working to build your credit before purchasing a home. Working with an experienced landlord is especially important when the rent-to-own agreement is being finalized as this type of contract has many unique aspects to it compared to a typical rental agreement. The same goes for other properties that might not explicitly be listed as rent-to-own but have the potential to become a rent-to-own property.

Is rent-to-own a good idea?

With a lease-option, you typically reserve the right to walk away from the deal at the end of your rental period. While you might lose the money you put down to secure the option to buy the property, a lease-option agreement might be a good option for renters who want to protect their interests and have an out. If you’re like most homebuyers, you’ll need a mortgage to finance the purchase of a new house.

There are 6,992 rent to own homes for sale in Los Angeles County, CA

But if the owner is in pre-foreclosure, they can benefit from the rent they collect from you while also securing a path to the eventual sale of the house. “If at any time the person that owns the home goes into foreclosure or they decide to sell the home, it’s very hard to be able to have the ability to get that money back that you’ve invested,” she says. “More people than I can count, the home went into foreclosure.” The renters had no clue there was even any trouble, and then the home was taken from under them. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place.

The Top 10 Viral Beauty Products to Snag for Less at Walmart

It’s difficult to know where your life will take you, so locking into a home purchase for some time in the future needs to be something you’re absolutely sure you want to do. One such specialty portal that can help you find quality leads for rent-to-own homes is foreclosure.com. They have thousands of listings where the seller may be willing to enter a rent-to-own agreement with the buyer to help them avoid foreclosure, and you can browse by state and even by county. Homeowners facing foreclosure might be especially open to a rent-to-own contract; the catch is that you cannot do a rent-to-own arrangement if the house is already in foreclosure.

CBRE Group (real estate), AECOM (engineering), and Guess (fashion) are a handful of internationally-accredited, successful organizations based in LA. Steph Mickelson is a freelance writer based in Northwest Wisconsin who specializes in real estate, building materials, and design. She has a Master's degree in Secondary Education and uses her teaching experience to educate and guide readers.

How significant a force is the build-to-rent (BTR) single-family home phenomenon? The National Association of Home Builders estimates approximately 10% of the nation’s new housing construction is destined to be offered as BTR product. If you do decide to pursue a rent-to-own home, no matter which way you go about finding one, it’s incredibly important to protect yourself against financial disaster. Get everything in writing, get a trusted expert to look it over, and don’t rush into anything — especially if it sounds too good to be true. Similarly, you and your agent may be able to find a landlord who’s looking for an escape hatch.

We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs. It takes just two minutes to match you with the best real estate agents, who will contact you and guide you through the process. When considering a rent-to-own home, working with a real estate agent experienced in these types of deals can help you navigate the process and find a great deal. A rent-back agreement allows sellers to rent their home from buyers for a set period of time, but it’s not without risks.

Home Partners of America, which we mentioned earlier, is one such company. Griffin recommends to her buyers that they make sure it’s a rental price that they can afford and that they can make sure they’re in an area where they can buy. “There’s just a lot of uncertainty around rent-to-own unless it’s an investment property,” she says. That’s why a specialist company can benefit the buyer — by removing some of the risks that the seller might not make good on their end of the deal.

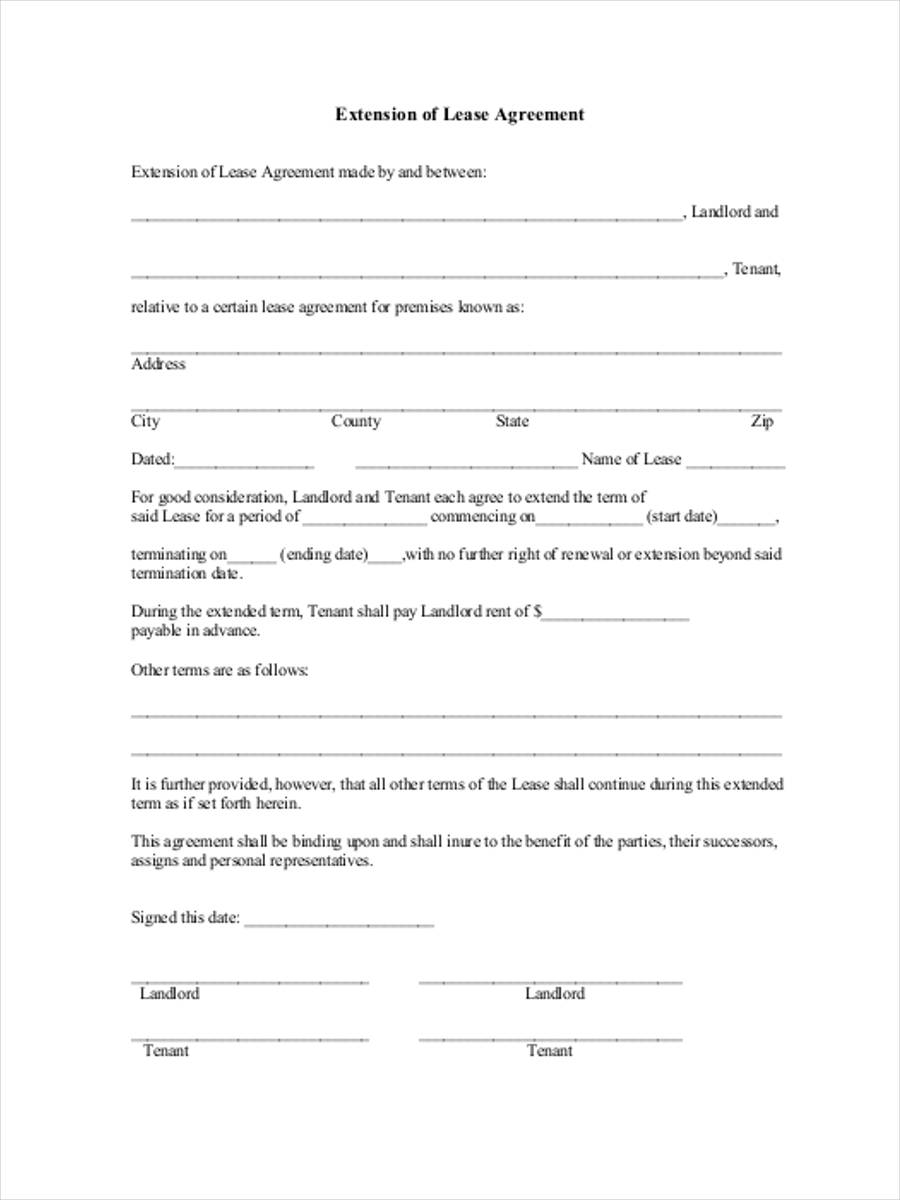

The rent credits you save during the lease term go toward your down payment if you buy the home. In most cases, your option fee will also reduce the property’s purchase price. A lease-option contract is similar to a standard rental lease but includes an option to purchase the home at the end of the lease term. If you choose not to buy, you will lose the option fee and, depending on the terms of the contract, possibly the down payment and any equity in the property. A lease-purchase agreement is very similar, in that you still put a certain percentage of your rent payments toward a down payment to buy the home.

The ideal candidate for a rent-to-own home is one who is not currently financially prepared to buy or concerned they may not qualify for a mortgage, but also knows exactly where they want to live. Ideally, the candidate has credit adequate to qualify for at least a Federal Housing Administration (FHA) home loan. Another upfront cost you should consider is paying for a home appraisal and home inspection. You might use these data points to evaluate whether the property is in good condition and worth your investment.

No comments:

Post a Comment